Does Sales Tax Have to be So Complicated?

Sales Tax: It can seem too business owners that calculating sales taxes is a simple and easy procedure. The only thing that requires to be done is taking the taxable product’s price and then add the state sales tax to it. However, there are several different nuances to this apparently simple process. Hence, it is prudent for business owners to hire professional tax calculation agencies for this purpose. Some of the varied rules include calculating sales tax on products depending upon the source of their origin, and sometimes on the destination of the final selling, sometimes there are different tax rates for the same product within the same state and jurisdiction. Thus, as a result of this, the process of calculating sales tax is far from being simple.

This small article will help you get some more details about how you should calculate sales taxes and give back the proper remittance amounts.

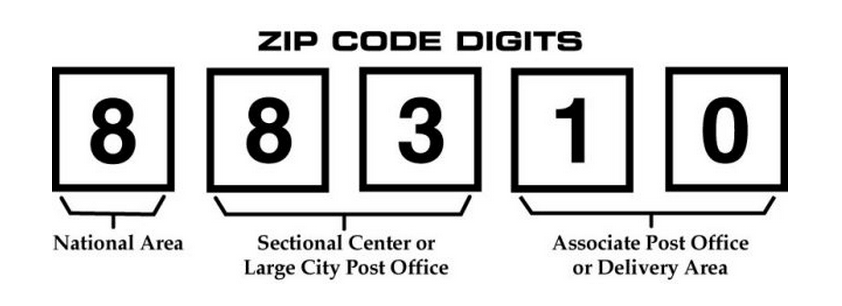

Understanding how ZIP Codes Work Here

There are several business owners who use ZIP codes to mistakenly try and locate the sales tax rates of their products. However, it is crucial that you understand that the specific regulations make it mandatory that the jurisdiction does not extend to cover the ZIP codes. In fact, there can be two customers who can live right by each other within the exact same ZIP code and still have different sales tax for the same product. Thus, it is useful in these regards, to use specific geolocation services to figure out the rate of sales tax. There are several tax calculation agencies that use these services to precisely calculate your sales tax.

When should you calculate your sales tax and collect it eventually?

The procedure of sales tax calculation and collection will vary across different businesses. For business owners who are into supplying construction hardware, they will have to follow a tax calculation procedure which follows the geolocation system. You will have to configure the system in a manner so that the precise state and local taxes are charged for your exact location.

In the event that you sell your products to your customers from a remote location, then there are several other factors that shall also come into consideration. Thus, you will need to make the following decisions:

- Does the item, that you sell, liable for taxation in either the state or the jurisdiction where your customers are located, you may also need to consider your own location in case you belong to a state where taxation is levied according to the source of the origin.

- In the event that you have found the nexus, then you will have to find the total rate of tax that will need to be charged. You will have to add the different state and extra local taxes in this calculation also.

A lot of small business owners find it really difficult to manage their sales tax procedures. This becomes more complicated when you have remittance and extra filing in this mix. In addition to this, there is another difficulty in the fact that the sales tax laws will change always and so the amount that you were charged last month can be different from the amount this month. A lot of business owners suffer from a miscalculation of their taxes and have even fallen out of legal compliance.

Why hire an external agency?

Calculating sales tax is complicated and a tiresome process. It is for this reason that a lot of companies and business owners hire external, third-party companies for calculating their sales taxes. These companies are professional agencies with all the different tools required to calculate taxes precisely. state sales tax calculator requires methodical calculation and precision and hence, it needs professional tools to ensure that charge the correct percentage and remits the proper amount. The filing process is also handled effectively by these companies. You can find such professional sales tax calculation agencies easily from the internet.

Conclusion

Calculating sales tax is not an easy job and entails a lot of precise work. Hence, it is best if business owners hired professional agencies for calculating the taxes properly. This will ensure that business establishments do not fall out of compliance with the state authorities.